Copyright © 2025 Sustainable Path, All rights reserved. Designed & Developed by int & Tech

- Help Center

- Track Order

- Learning Center

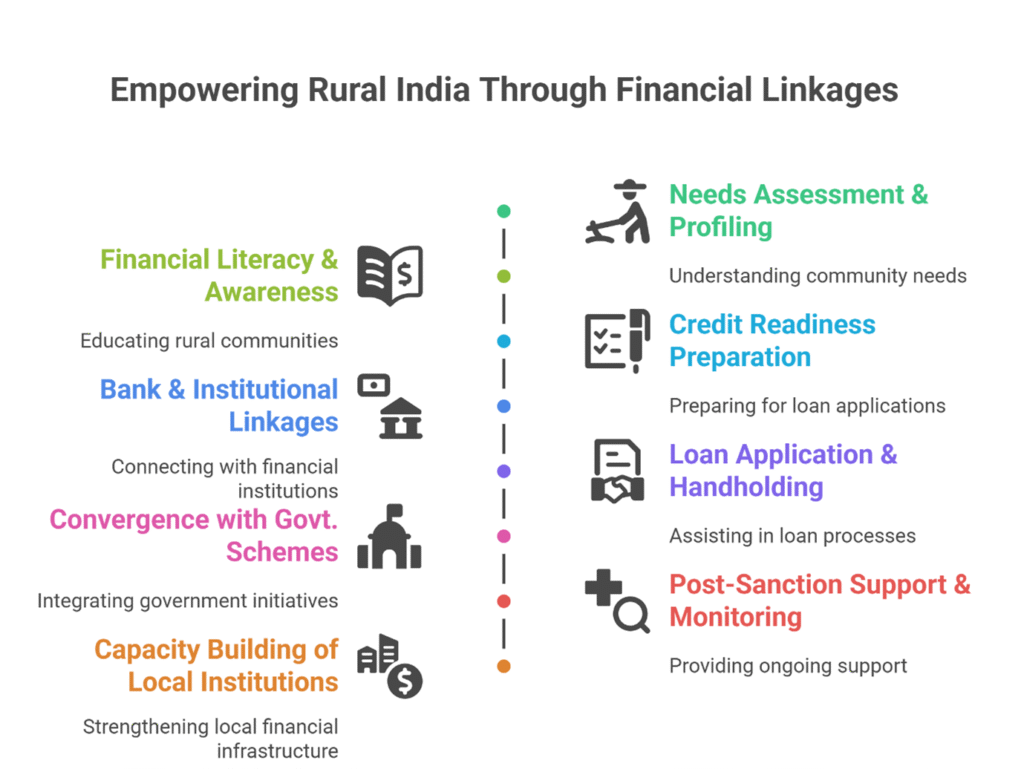

Lending and Financial Linkages for Agri-Allied Activities

1. Needs Assessment & Profiling

- Identify the credit needs of farmers, fishers, SHGs, and rural entrepreneurs.

- Assess the type of agri-allied activity (e.g., aquaculture, poultry, dairy, horticulture, food processing).

- Profile potential borrowers based on enterprise type, scale, and repayment capacity.

2. Financial Literacy & Awareness Building

- Conduct training sessions on financial planning, banking processes, and responsible borrowing.

- Orient communities on government-backed loan schemes (PMFME, PMMSY, AIF, etc.).

- Raise awareness about interest subvention, subsidies, and credit guarantee mechanisms.

3. Credit Readiness Preparation

- Support in organizing required documents (KYC, land lease papers, enterprise plans, etc.).

- Help individuals and groups prepare basic business or project proposals.

- Assess group strength and repayment track record for SHGs, JLGs, or cooperatives.

4. Facilitating Bank & Institutional Linkages

- Establish partnerships with banks, MFIs, NBFCs, and cooperative institutions.

- Facilitate formal meetings between lenders and borrowers.

- Advocate for flexible and inclusive financial products suited to rural enterprises.

5. Loan Application & Handholding Support

- Assist in filling out loan applications and submitting them to financial institutions.

- Follow up with banks and help resolve queries or compliance gaps.

- Guide beneficiaries through technical appraisals or pre-sanction visits if needed.

6. Convergence with Government Schemes

- Align eligible applications with central/state schemes for subsidies or soft loans.

- Ensure timely registration on relevant scheme portals and support claim processing.

- Facilitate fund flow tracking and compliance reporting as per scheme requirements.

7. Post-Sanction Support & Monitoring

- Educate beneficiaries on loan usage, repayment schedules, and EMI planning.

- Offer business advisory and technical guidance to ensure profitable use of funds.

- Monitor utilization and provide support to prevent defaults and distress.

8. Capacity Building of Local Institutions

- Train local producer groups, FPOs, and SHG federations in financial management.

- Promote the development of village-level credit facilitation centers or CRPs.

- Build systems for credit tracking, internal lending, and group-level financial discipline.

To find out more about our services for

Financial Institutions

Customer Service

+91 8249288302

E-mail US

support@sustainablepath.com

Office Address

Birakishorepur, Athagarh, Cuttack - 754029,

Orissa

Get to Know Us

Our Service

Orders & Returns

Our Policy